Auto insurance without a driver’s license is a topic that can be confusing for many individuals. While it may seem counterintuitive to some, there are actually ways for individuals without a driver’s license to obtain auto insurance coverage.

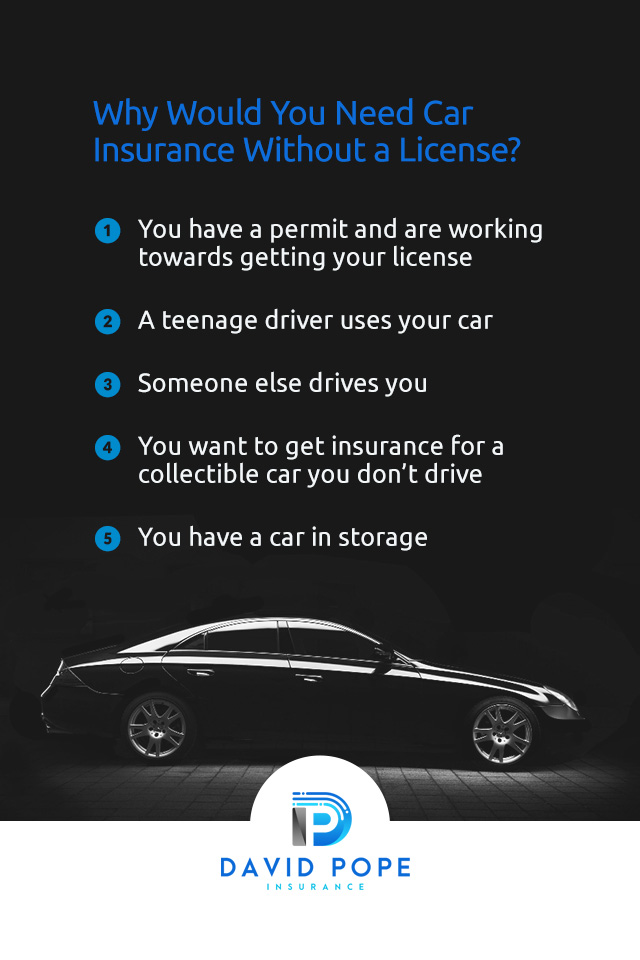

One common scenario where auto insurance without a driver’s license may be necessary is if an individual owns a car but does not drive it themselves. This could be the case for someone who has a caregiver or family member who uses the car on their behalf. In this situation, the owner of the car can still insure the vehicle in their name, even if they do not have a driver’s license.

Another scenario where auto insurance without a driver’s license may be needed is if an individual is in the process of obtaining their driver’s license. In some cases, individuals may still want to insure a car that they own before they are able to legally drive it. In these situations, insurance companies may offer policies specifically designed for individuals in this situation.

It’s important to note that while it is possible to obtain auto insurance without a driver’s license, it may be more challenging to find coverage and the cost of insurance may be higher. Insurance companies typically consider a driver’s license as a key factor in determining rates, as it demonstrates a level of driving experience and responsibility.

Additionally, individuals without a driver’s license may need to provide additional documentation or information to insurance companies in order to obtain coverage. This could include proof of identity, proof of ownership of the vehicle, and information about the driver who will be using the car.

For individuals in this situation, it may be helpful to work with an insurance agent who specializes in non-standard or high-risk insurance. These agents have experience working with individuals who may have unique circumstances, such as not having a driver’s license, and can help them find appropriate coverage.

Overall, while obtaining auto insurance without a driver’s license may be more challenging, it is still possible for individuals in certain situations. By working with a knowledgeable insurance agent and providing the necessary information, individuals can ensure that their car is properly insured even if they do not have a driver’s license.